Ghana’s Betting Tax Remains in Effect: Debunking Social Media Rumors

Accra, Ghana – January 3, 2025 – Recent social media claims suggesting the repeal of Ghana’s betting tax have been debunked as false and misleading. These rumors emerged following the declaration of John Mahama as President-Elect, even though his inauguration is yet to take place. The 10% withholding tax on betting winnings, introduced in August 2023 under the Income Tax (Amendment) Act, 2023 (Act 1094), remains firmly in place.

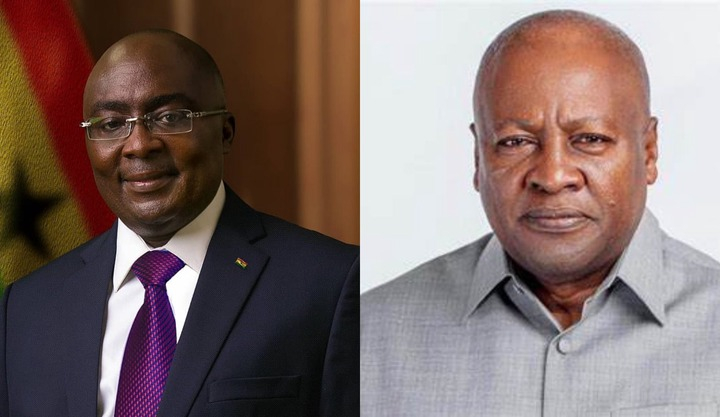

The betting tax, implemented by the Ghana Revenue Authority (GRA), forms part of a broader strategy to enhance revenue generation within the gaming industry. During the election campaigns, both leading presidential candidates, John Mahama and Dr. Mahamudu Bawumia, pledged to abolish the tax if elected. However, campaign promises do not translate into immediate policy changes. Crucially, Article 174 of the 1992 Constitution mandates that any alteration or repeal of existing tax laws requires an Act of Parliament. To date, no such action has been initiated or communicated to Parliament concerning the betting tax.

The GRA, the responsible authority for tax administration, has also not issued any official statement confirming the removal of the betting tax. Therefore, assertions circulating on social media about its abolition are unsubstantiated and should be disregarded. The public is urged to exercise caution and verify information from credible sources before accepting it as factual.

The process of repealing a tax, like any other policy change, involves a series of well-defined legal steps. First, the proposed repeal must be presented to Parliament as a bill. This bill undergoes rigorous scrutiny and debate within the parliamentary committees. Following successful passage in Parliament, the bill is presented to the President for assent, officially becoming law. Only then can a tax be legitimately repealed.

Furthermore, it is essential to understand the constitutional context surrounding taxation in Ghana. Article 174 of the 1992 Constitution vests the power to impose, alter, or repeal taxes solely in Parliament. This provision underscores the principle of democratic accountability in fiscal matters, ensuring that any changes to the tax regime undergo proper legislative scrutiny and public debate. This constitutional safeguard prevents arbitrary or unilateral decisions on taxation, thereby protecting the interests of citizens.

The premature celebration of the supposed repeal of the betting tax highlights the dangers of misinformation and the importance of relying on verified information from official sources. The dissemination of false news can lead to public confusion, misinformed decisions, and even undermine trust in government institutions. Responsible citizens are encouraged to seek out information from reputable news outlets, official government websites, and other credible sources before accepting information as true, especially on sensitive matters like tax policy.

The current situation serves as a reminder that changes in tax legislation require a structured process and cannot be implemented merely based on campaign promises. While the incoming administration may have intentions to review or amend the betting tax, any such action must adhere to the constitutional and legal framework. Transparency and due process are crucial to ensure public trust and maintain the integrity of the legislative process.

The GRA continues to enforce the existing betting tax law, and all betting operators and individuals are expected to comply with their tax obligations. Any updates regarding the betting tax or other tax policies will be communicated through official channels, including the GRA website and official government announcements. The public is advised to remain vigilant and seek accurate information from authorized sources to avoid being misled by inaccurate reports circulating on social media or other unofficial platforms.

This incident underscores the need for greater media literacy and critical thinking skills. Citizens should be equipped to evaluate the credibility of information sources and identify potentially misleading content. By verifying information and relying on credible sources, individuals can contribute to a more informed and responsible public discourse.

The GRA remains committed to providing accurate and timely information on tax matters and encourages the public to seek clarification on any tax-related issues through its official communication channels. The authority also reiterates its commitment to enforcing the existing tax laws effectively and ensuring compliance from all stakeholders in the gaming industry.

In conclusion, the betting tax in Ghana remains in effect. The recent social media rumors regarding its repeal are unfounded and lack any official basis. The GRA has not issued any statement confirming the removal of the tax, and the legal process for repealing a tax requires an Act of Parliament, which has not yet been initiated. The public is advised to disregard these rumors and rely on official sources for accurate information.