San Francisco Tech Couple Indicted on 25 Federal Counts in Alleged $60 Million AI Fraud Scheme

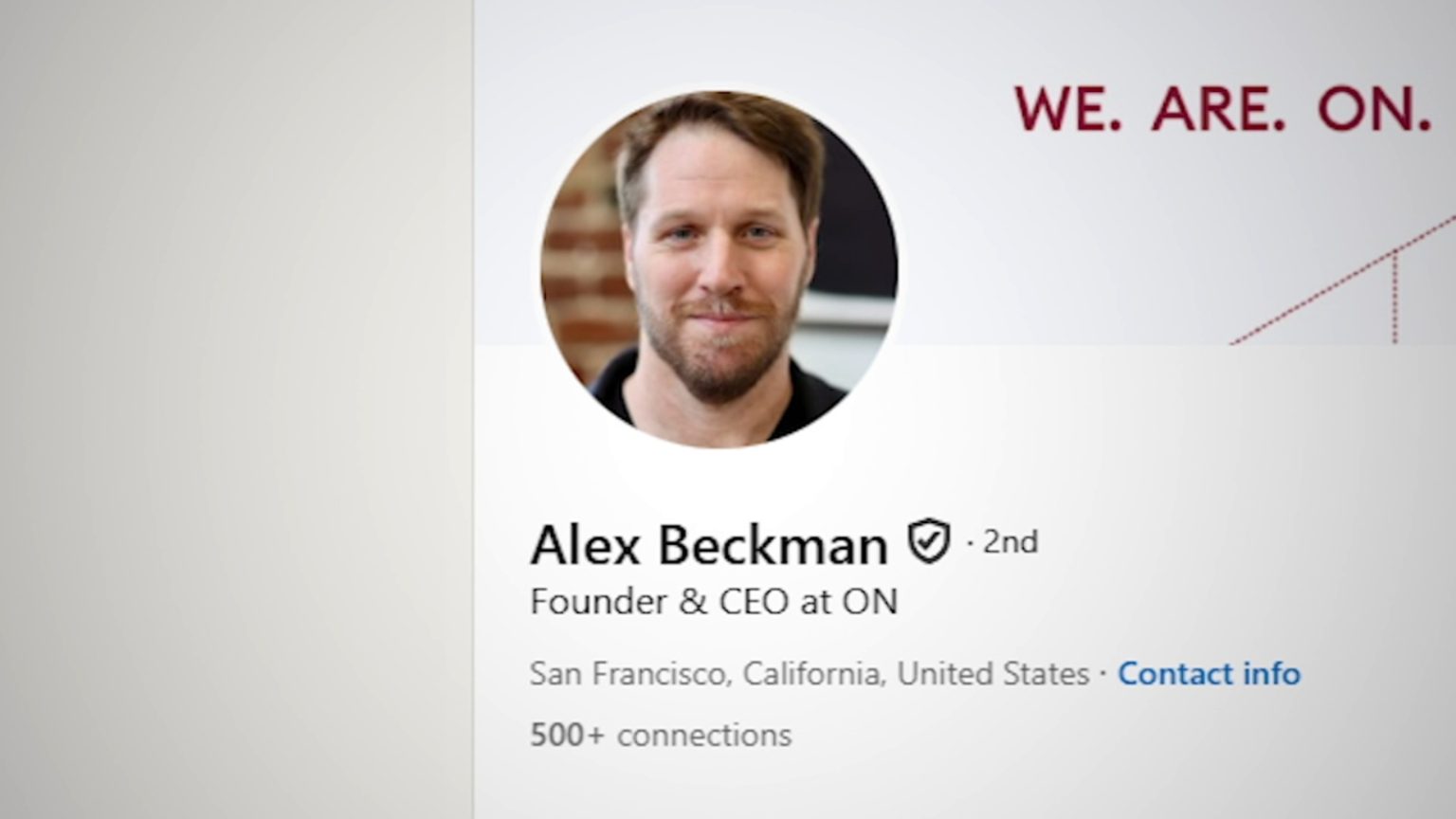

San Francisco, CA – A local couple has been arrested and charged with 25 federal counts related to an alleged multi-million dollar fraud scheme involving their artificial intelligence company, GameOn Inc. Alexander and Valerie Beckman, the founder and former CEO, and the corporate attorney of GameOn respectively, are accused of defrauding investors out of $60 million over a six-year period, using a complex web of fabricated financial documents, inflated revenue figures, and fictitious customer relationships. GameOn, which developed chatbot software mimicking human interaction, boasted a client list that included prominent professional sports leagues, teams, and luxury fashion brands, according to the Department of Justice.

The indictment, unsealed this week, paints a picture of a meticulously orchestrated deception involving wire and securities fraud, conspiracy, identity theft, and obstruction of justice. Prosecutors allege that Alexander Beckman, the mastermind behind the scheme, falsified financial records, fabricated audit reports bearing the trademarks of reputable accounting firms, and impersonated at least seven individuals, including a GameOn CFO, bank employees, and a professional sports league employee. He allegedly used fake email addresses and forged signatures to distribute these fraudulent documents to investors, creating a mirage of financial stability and success.

Adding to the complexity of the case, Valerie Beckman, an attorney who handled GameOn’s corporate and transactional matters, is accused of actively participating in the deceit. The indictment alleges that she provided her husband with genuine audit reports from her own employer, which he then manipulated to create fraudulent GameOn audit reports. She is also accused of personally sending one of these fabricated reports to a GameOn investor, knowingly misrepresenting the company’s financial health to encourage further investment. Furthermore, Valerie Beckman allegedly lied to her employer about her involvement with GameOn and subsequently attempted to delete hundreds of files related to her work for the company when a grand jury investigation was initiated.

The couple’s alleged misuse of investor funds reportedly extended to lavish personal expenses, including the purchase of homes in San Francisco, private school tuition, and financing their wedding, which took place in October 2023. Approximately $4 million of the $60 million raised from investors was allegedly diverted for these personal uses, betraying the trust placed in them by those who believed in GameOn’s potential.

The Beckmans face a daunting array of potential penalties if convicted. Each count of wire and securities fraud and wire fraud conspiracy carries a maximum sentence of 20 years in federal prison. The securities fraud conspiracy count carries a five-year maximum sentence, while the bank fraud conspiracy and false statements to a bank counts carry a maximum sentence of 30 years each. Other charges, including engaging in monetary transactions in property derived from specified unlawful activity and aggravated identity theft, carry maximum sentences of 10 years and two years per count, respectively. Valerie Beckman also faces an additional 20-year maximum sentence for the obstruction of justice charge.

This case highlights the increasing risks associated with investments in the rapidly evolving tech industry, particularly in emerging fields like artificial intelligence. The alleged elaborate deception underscores the importance of thorough due diligence and scrutiny of financial records, especially in private companies. The Justice Department’s pursuit of this case sends a strong message about its commitment to protecting investors and holding individuals accountable for fraudulent activities, regardless of their position or sophistication. The outcome of this case will be closely watched by the tech community and the investment world alike.

The unfolding legal proceedings will undoubtedly shed further light on the intricate details of the alleged fraud and the extent of the Beckmans’ involvement. The case serves as a cautionary tale for both investors and entrepreneurs, emphasizing the critical importance of transparency and ethical conduct in the pursuit of innovation and financial success. As the legal process progresses, the full scope of the alleged scheme and its impact on the victims will become clearer. The outcome of the trial will send a significant message about accountability and the consequences of exploiting investor trust in the burgeoning tech industry.