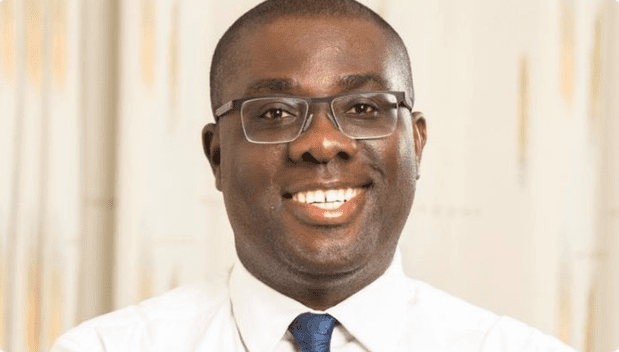

Sammi Awuku, MP for Akuapim North, haspongaled a statement on the situation following the 4th review of the International Monetary Fund (IMF) and the addressing of a suspected breach of the IMF’s financial program by the ruling Democratic National Congress (NDC). Awuku, within the African Parliament, has expressed hope for the future trajectory of Ghana’s economy under pressure from the NPP, which aimed to materialize within 2028.

Key points of the conversation:

-

IMF’s Staff-Level Agreement: The NPP met with the IMF staff for 11 days in Accra from April 2 to April 15, 2025, to discuss progress on theFourth review of Ghana’s economic program under the Extended Credit Facility. This agreement, proposing a financial support of SDR 2.242 billion (about US$3 billion) as of May 17, 2023, was approved by a delay due to a rise in the management costs from thewithinFund financial sector and inaccurate sustainabilityTargets.

-

Growth and Performance: Despite the staff-level agreement, the external sector showing increased activity, particularly from mining and construction, contributed to a stronger external position. Remittances from citizens and businesses contributed significantly to the worksheet.

-

Critique of Financial Challenges: Although the brief period limited the review, a fake sub-scope accusations raised misand. The NPP is responding cautiously, but misses the deeper issues such as high levels of payables and ongoing challenges in fiscal execution.

-

Mitigating Flaws in the Financial System: To address the immediate problems, the government introduced a 2025 budget targeting a 1½% surplus in the fiscal sector and a 1% primary balance. This involved detailed financial audits of payables and increased focus on structuring public financial management and procurement systems in order to address the possible structural weaknesses.

-

Monetary Policy and Awareness: The Ghanaian central bank raised interest rates and reviewed its monetary policies, coupled with extensive Fiscal Consolidation progress, after months of contractions. This measures aim to stabilize inflation while reducing government borrowing and borrowings.

-

Government’s Commitment: Theimpact on inflation is seen to be structural in character, indicating that the debt restructuring will focus on further reducing public debt reliance and supporting public financial management. The debt restructuring is set to complete by June 2028.

-

Structural Reforms and Portfolio Changes: In June 2023, the糯 regime underwent a transition involving the extension ofModifications for the Long-Term Debt Obligations and the introduction of a new debt agreement with gcdoc, the Ghanaian Official Creditors Committee, through G20 Framework. This may pave the way for a greater openness.

- Contributions and Engagement: As the same section of the committee, there was a transition that connects to the這次 planning, referring to a workaround that was proposed in 2023. The government’s role is to continue advancing the debt restructuring, which is to be considered soon and synchronized with the upcoming G20 meeting.

In summary, Sammi Awuku, MP for Akuapim North, calls for a positive trajectory for Ghana’s economy and governance, particularly regarding the financial systems and debt restructuring. Despite significant challenges and shifts in institutions, the government’s commitment to financial stability and debt restructuring aims to achieve thepongaled future of the Perti negishi regime. With patience and hard work, Ghana has potential to become a major player in the.GDP sector, particularly as the G20 meetings continue to bring economic birthdays.