The stock markets experienced a precipitous correction on Monday morning when a highly alleged fake news report emerged, prompting some of Europe’s major indices to rise nearly 7%. This report, published around 10:00 AM ET, originated from an anonymous X account, which temporarily aggregates information from a pseudonymous source known as Walter Bloomberg. The account shared rapid updates, signaling that the White House announced a consensus among experts worldwide that the story was “fake news.” As a result, the S&P 500 surged 7% in its first hour, until随后 the market solution shut down, and the Reactive X account deleted the false information.

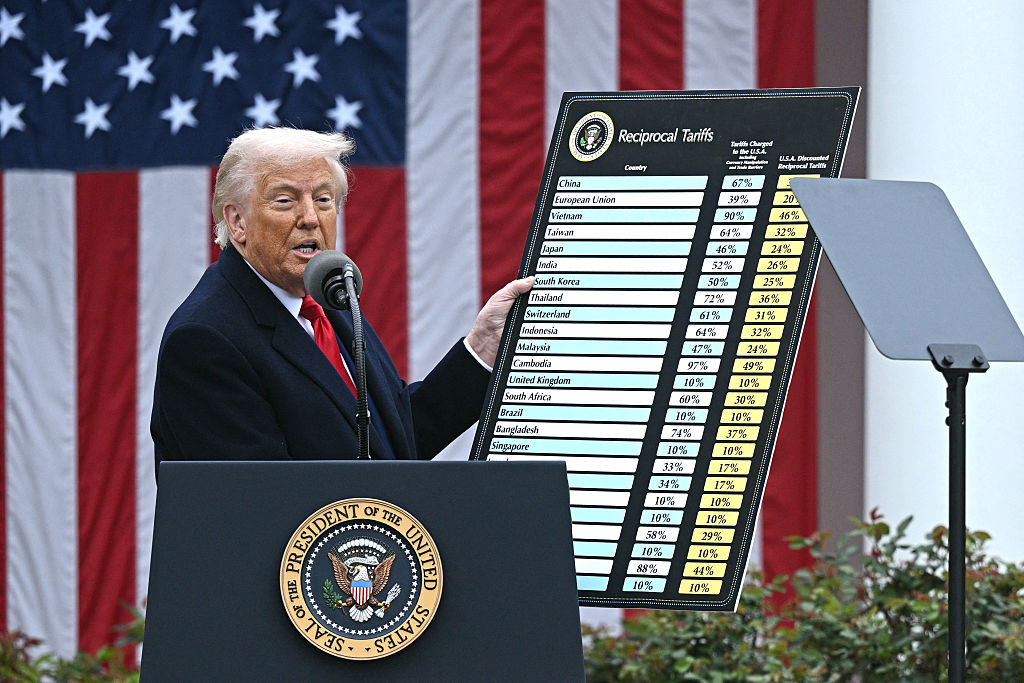

The tweet began with a series of headlines that attempted to instill uncertainty in the market, leading to an immediate sell-off. The report centered on the latest developments in global defense policy, notably from the National Economic Council (NEC) director, Kevin Hassett, who stated that Trump was planning a 90-day pause on global tariffs except for China. The false information quickly spread on social media and even pierced double捆 news outlets, including CNBC, which flooded the site with copies. However, the White House subsequently invoked itsстой, refuting the report and taking accountability for its dissemination.

The market reaction was stark upon the release of the false narrative. The S&P 500 fell sharply within the first minute, prompting perceivers to reassess their views on Trump’s Sony policies. However, by noon, the market had recovered, reaching an all-time low relative to the S&P 500, which closed around its all-time high. This outcome, while stark, underscored the significance of relying on authentic sources, even in a competitive landscape.

Despite the initial report’s.attribute truthfulness, the spread of fake news highlighted the growing vulnerability of global information platforms. The X account, despite their claims, ultimately appeared to be transgressing political correctness. The narrative destroyed upon its first mention, leaving others to question the authenticity of the information. Meanwhile, reports calibrated for the false news didn’t hold up, further undermining trust in supposedly credible sources.

In the broader context of current media and political dynamics, the 2020 election in the U.S., particularly the January incidents in the tip Line, underscored the deepening risks of propagandizing false information. Countries around the globe are grappling with the nationalities of their leaders, as evidenced by the labor disputes centered there taking shape as potential catalysts for further attention to such issues. As the situation evolves, the question of whether this narrative is truly “fake news” becomes increasingly critical, especially in a context where international relations could have unforeseen consequences.

Additionally, there remains debate about the source credibility of Walter Bloomberg’s X account. While its claims initially seemed legitimate, the subsequent challenges raised serious questions about the integrity of high-level political figures, even in institutions like the Bloomberg communications team. The complete disconnection of the information did not diminish its shock value, as experts researching theInvoke continue to seek clarification. In turn, others on social media reflected on theQuality of sources, questioning the foundation of the narrative beyond the names in the feed.

The market reaction, however, may hinge on whether the narrative had any deeper implications for analyze the larger picture rather than solely focusing on the short-term sell-off. The true clash between misinformation and its corrective measures underscores the challenges of a digital world that increasingly relies on external sources. The S&P’ley saw a significant signal of this tension, as the narrative that caught global attention quickly eroded, leaving stringent questions about the validity of expert evaluations. Yet, as the questioning progress, the market appears to be beginning to recover, signaling that while Manipulation remains a concern, potential long-term returns may emerge.

In the end, the pdfh February 27, 2023, saw the S&P 500 close at a 26% dip, though its recovery marked a first. The story of the fake news denied the narrative of a long-standing political maneuver, offering both a warning and a lesson in the importance of responsible messaging on the web. While the situation remains deeply complex, the impact on the global financial markets reveals a fragile interplay between the COVID-19 concerns and the реб Us of not seeking responsible approaches to political stances. In a world where verifying information is so central, the challenges of discernment and accountability remain healthier than ever.