Nigeria’s Tax Reform Sparks North-South Tensions, False Claims Emerge

Nigeria is currently embroiled in a heated debate over proposed tax reforms, with tensions rising between the predominantly Muslim north and the largely Christian south. The reforms aim to streamline the country’s complex tax system, reduce the number of levies, and attract investment. However, they have ignited controversy, with some in the north perceiving them as a deliberate attempt to disadvantage their region. Amid this tense atmosphere, false information has proliferated on social media, further exacerbating the situation.

The heart of the dispute lies in the distribution of tax revenue. Nigeria operates a federal fiscal system, where taxes are collected centrally and then allocated among the federal government, 36 states, and 774 local administrations. The northern region, which relies heavily on these federal allocations, views certain aspects of the proposed reforms as a ploy to diminish its share of the revenue. One of the contentious bills, in particular, has sparked concerns that it will disproportionately impact the north, exacerbating existing economic disparities.

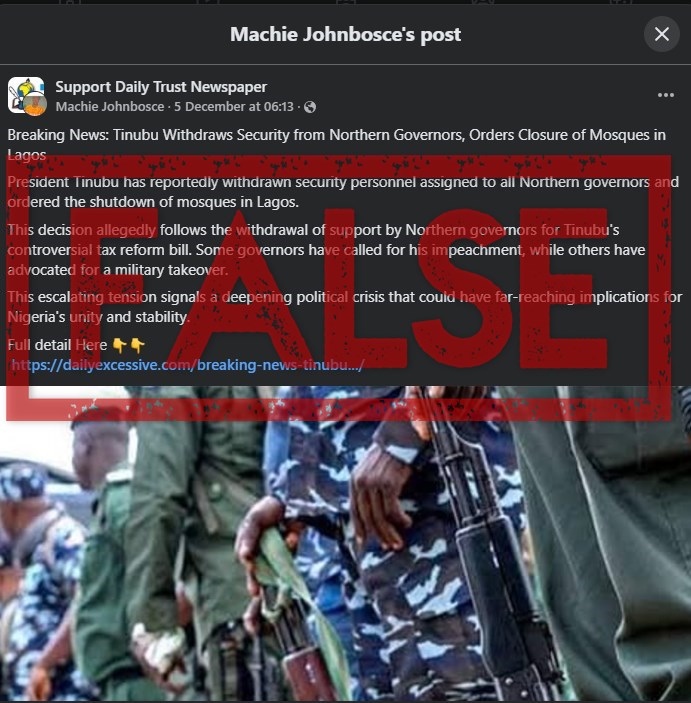

Adding fuel to the fire, false claims have emerged on social media alleging that President Bola Tinubu, a southerner, has taken drastic measures against northern governors and Muslim communities. These posts, circulating widely on platforms like Facebook and Instagram, allege that Tinubu ordered the withdrawal of security personnel from northern governors and the closure of mosques in Lagos. These accusations have further inflamed tensions and fueled distrust between the north and south.

However, a thorough investigation has revealed these claims to be entirely baseless. No credible news outlets, either local or international, have reported any such events. Furthermore, a presidential spokesperson categorically denied the allegations, dismissing them as malicious attempts to sow discord and create a crisis. Representatives of the Muslim community in Lagos have also confirmed that mosques have continued to operate without interruption.

The spread of disinformation in this sensitive climate underscores the importance of verifying information from reliable sources. False narratives can easily exploit existing tensions, further polarizing communities and hindering constructive dialogue. In the context of Nigeria’s ongoing tax reform debate, the circulation of these unfounded accusations only serves to deepen the divide between the north and south, making it more challenging to achieve a consensus on this crucial issue.

The proposed tax reforms are intended to simplify tax administration, reduce the burden on businesses, and attract both local and foreign investment. Nigeria, which heavily relies on oil revenue, seeks to diversify its economy and create a more conducive environment for businesses to thrive. The reforms propose to consolidate over 50 existing taxes into a few key levies and reduce corporate tax rates from 30% to 25% over the next two years. These changes, proponents argue, will create a more efficient and predictable tax system, stimulating economic growth and benefiting the entire nation. However, addressing the concerns of the northern region and bridging the trust deficit caused by misinformation will be crucial for the successful implementation of these reforms.

It is essential for all stakeholders to engage in open and constructive discussions to find common ground. Addressing the economic anxieties of the north and ensuring equitable distribution of resources will be critical to building consensus and moving forward with reforms that benefit all Nigerians. The focus should remain on the substantive issues of tax reform and economic development, rather than being sidetracked by unsubstantiated accusations and divisive rhetoric. By working together and relying on factual information, Nigeria can navigate this challenging period and achieve its economic goals.