Cybersecurity Experts Expect a Significant Surge in Tax-Related Scams in the Final Month Before Tax Day

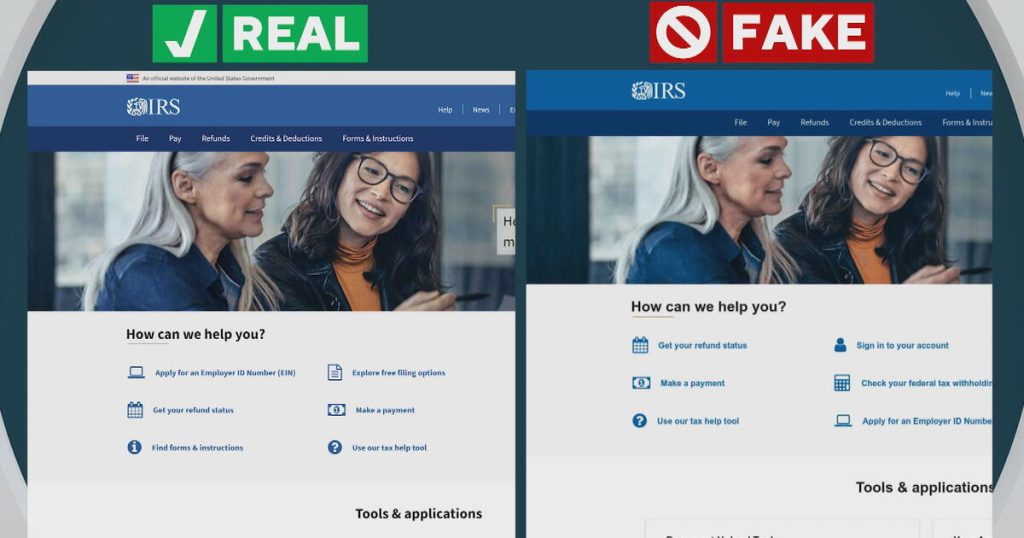

From the previous reports, we observe a significant rise in tax-related scammers before Tax Day. A study by DNSFilter reveals that traffic to domains with "tax" in their name peaked 30 days before Tax Day in 2024, indicating a heightened attention to these types of scams. Phishing and smishing remain the predominant methods, as attackers use email, text, or phone calls to infiltrate legitimate entities like the IRS to steal personal information.

Why Tax Scammers Still Preciously Steal Our Information

According to McAfee, the average tax scmer lost an average of $8,199 last year, suggesting a persistent issue. The IRS emphasized that it will never threaten legal action, refund, demand payment through text or email, or call. Thus, prevention is paramount. The reassuring message from the IRS underscores the importance of securing our tax documents and being cautious of real_helper websites that impersonateThird parties.

Increased Illegal Imposters in 2025

Guardio, a leading cybersecurity firm, highlighted a 77% rise in phishing scams in 2025. This increase stems from the use of artificial intelligence to create realistic imposter websites and emails, increasing the quality of these scams. "It’s increased the quality of scams," said Karin Zilberstein, a Guardian firm expert, focusing on how scammers now employ AI to mimic real imposter websites, enhancing their simulations ofLeo purpose.

deceptive in.dstributary Privacy Advice

American bureaucratic agents caution users to stay informed about tax affairs, particularly on social media platforms like TikTok, where inaccurate tax advice is rampant. Claiming ineligible credits could lead to hefty fines and delays in owing Fraudulenties. The IRS warns against misleading advice, promoting a self-employment credit referred to as the "Credits for Sick Leave and Family Leave," which is distinct from the potential Self-Employment Tax Credit, a common misconception.

Conclusion: Precautionary measures are necessary but have to be taken with care. The increasing attention to tax affairs, the persistence of these scams through improved online tools and methods, and the credibility of tax agencies necessitate vigilance.

Next Text: "Joshua Sidorowicz is an investigative reporter specializing in consumer issues and misinformation at CBS News Philadelphia."